August 29, 2019

The company will hold a conference call with management on Tuesday, Sept. 3

VANCOUVER, BC, and PHOENIX, AZ, August 29, 2019 – 4Front Ventures Corp. (CSE: FFNT) (OTCQX: FFNTF) (“4Front” or the “Company”), announces the interim unaudited financial results of 4Front Holdings LLC (“4Front Holdings”) for the quarter ended June 30, 2019 (“Q2 2019”). Because Q2 2019 predated the closing of 4Front Holding’s business combination with Cannex Capital Holdings, Inc. (“Cannex”) on July 31, 2019, the reported and filed financial results are not consolidated and do not reflect the results of Cannex for the period. The financial statements reported for Q3 2019 will reflect the results of Cannex as consolidated into the combined resulting issuer, 4Front.

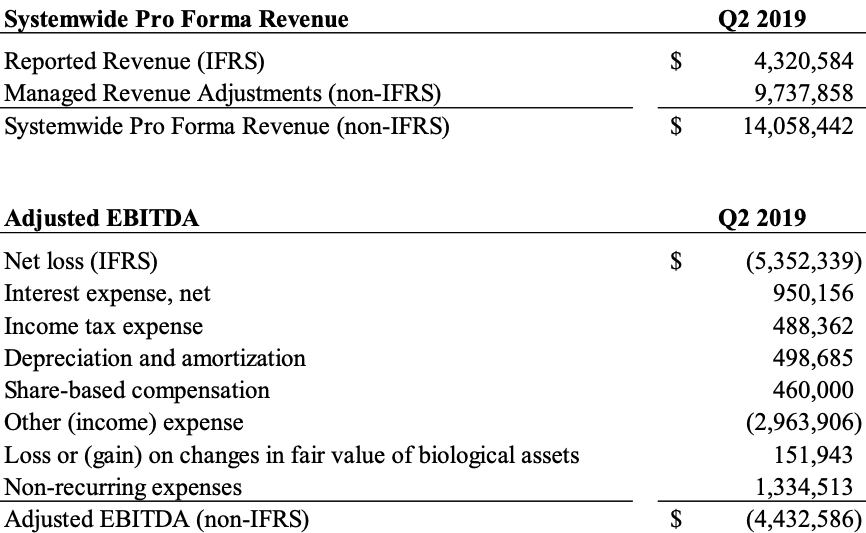

While the reported and filed Q2 2019 results don’t include Cannex, the Company is sharing a calculation called Systemwide Pro Forma Revenue* that includes information related to Cannex as defined below.

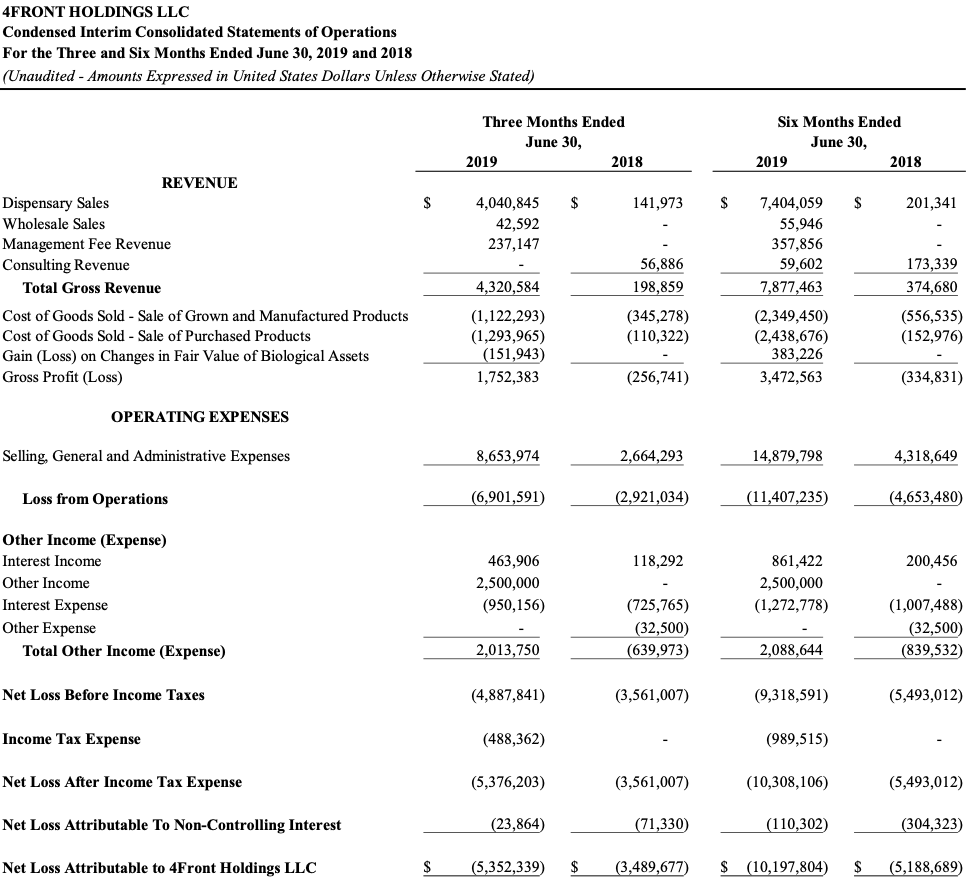

Q2 Financial Results

- Systemwide Pro Forma Revenue* of $14,058,442 compared to $7,940,731 in Q2 2018

- Revenue for 4Front Holdings of $4,320,584 compared to $198,859 in Q2 2018

- Adjusted EBITDA* for 4Front Holdings for the Q2 2019 was a loss of $4,432,586

(*Systemwide Pro Forma Revenue and Adjusted EBITDA are not measures included in the International Financial Reporting Standards (IFRS). Please see discussion of Non-IFRS measures below.)

“I am proud of the growth 4Front has achieved, and I’m excited by the anticipated acceleration in our growth and capabilities resulting from our merger with Cannex,” said Josh Rosen, 4Front CEO. “As we continue to invest in our infrastructure and our people, I am much more focused on achieving operational milestones than how those milestones present through the lens of IFRS accounting. I expect that, like high-growth companies in this and other industries, we will generate accounting losses as we build out operations and aggressively add and train staff, with an eye on market leadership within the adult-use markets we’re prioritizing. However, we expect the underlying operations in each state to quickly become cash-flow positive on a standalone basis as we complete projects over the coming eighteen months.”

Key Operational Updates and Subsequent Events

- On July 31, 2019, Cannex and 4Front Holdings completed their business combination forming 4Front Ventures.

- During Q2 2019, 4Front started planting at its new production facility in Worcester, Mass., with the first of what will become perpetual harvests anticipated in Q4 2019.

- 4Front began an optimization project in its Georgetown, Mass., production facility that should double cultivation capacity, with the resulting yields anticipated to begin showing up in Q4 2019 harvests.

- Mission, 4Front’s retail division, opened a new dispensary in Rockville, Md. It is the third Mission dispensary in Maryland and is the result of a management and licensing relationship with the original license holder.

- Brightleaf, 4Front’s production division, gained control of the entire 94,000 square foot building in Elk Grove Village, Ill., where the Company’s existing production operation is housed. Design work is under way to support a substantial expansion of that operation in response to the adult-use legislation passed in June.

Upcoming Milestones

- Operating Milestones

- The integration of 4Front’s legacy production facilities onto the Brightleaf platform was immediate upon the closing of the merger.

- Brightleaf expects to introduce the legacy Cannex brands into the Massachusetts market during Q3 2019.

- 4Front anticipates approval for its Georgetown Mission retail and Brightleaf production operations to begin to serve the adult-use market, in addition to the medical market they already serve, in the next 45 days, with its retail and production facilities in Worcester, Mass., expected shortly thereafter.

- Pure Ratios’ THC-enhanced product line is being re-introduced into the California market

- Project Milestones

- Brightleaf anticipates completing the redesign and retrofit of the Georgetown production facility by Q4 2019, which is anticipated to nearly double the production capacity through additional canopy and higher efficiency.

- In addition to the redesign and retrofit, Brightleaf plans to begin construction in Q4 2019 on the expansion of its Georgetown production facility to approximately triple the flower canopy by the end of 2020.

- People Milestones

- In keeping with its mission to be a magnet for talent in the industry, 4Front is close to completing the formalization of a Brightleaf management training program for cultivation and production. This initiative will create a program to match the retail management training platform Mission has been successfully using and iterating since 2011.

- As operations continue to expand, the Company is in the process of making some key hires to add seasoned operational and back-office talent to support the anticipated rapid growth curve.

“We’re building our business on what I like to think of as four pillars: experienced and committed leadership, battle-tested operating capabilities, a strategic approach to growth and capital allocation, and a commitment to being a magnet for talent in the industry,” Rosen said. “As I stated on our conference call in early August after we closed our merger with Cannex, when we articulate internally and externally what we’re playing for, it’s to build a company the right way with $200 million in EBITDA; I’m delighted with how our team and strategic asset platform is coming together and I look forward to sharing future updates related to our aggressive plans.”

Additional Details

As of close of business today, 4Front would have a basic total of 530,852,417 shares outstanding, when calculated as if all share classes were converted to Subordinate Voting Shares, and a fully diluted total of 577,304,3991 million shares when calculated on the same basis. For further details regarding 4Front’s share structure, please see its profile at www.thecse.com.

As of the closing of the merger between Cannex and 4Front on July 31st, 2019, the company had $38.2 million of available and restricted cash (including $15.8 million of cash available but not drawn under the debt associated with real estate-related assets), $33.5 million of convertible debt outstanding and $50 million of debt associated with real estate-related assets.

1Using the treasury stock method as of August 29, 2019.

Financial Results Conference Call

The Company will host a conference call with management on Tuesday, September 3, at 9 a.m. PST. Join by dialing 1-877-407-0792 toll free from the United States or Canada or 1-201-689-8263 if dialing from outside those countries.

The call will be available for replay if you’re unable to join. To access the replay, which will be available until September 10, dial 1-844-512-2921 toll free from the United States and Canada, or 1-412-317-6671 if dialing from outside those countries, and using this replay pin number: 13694074.

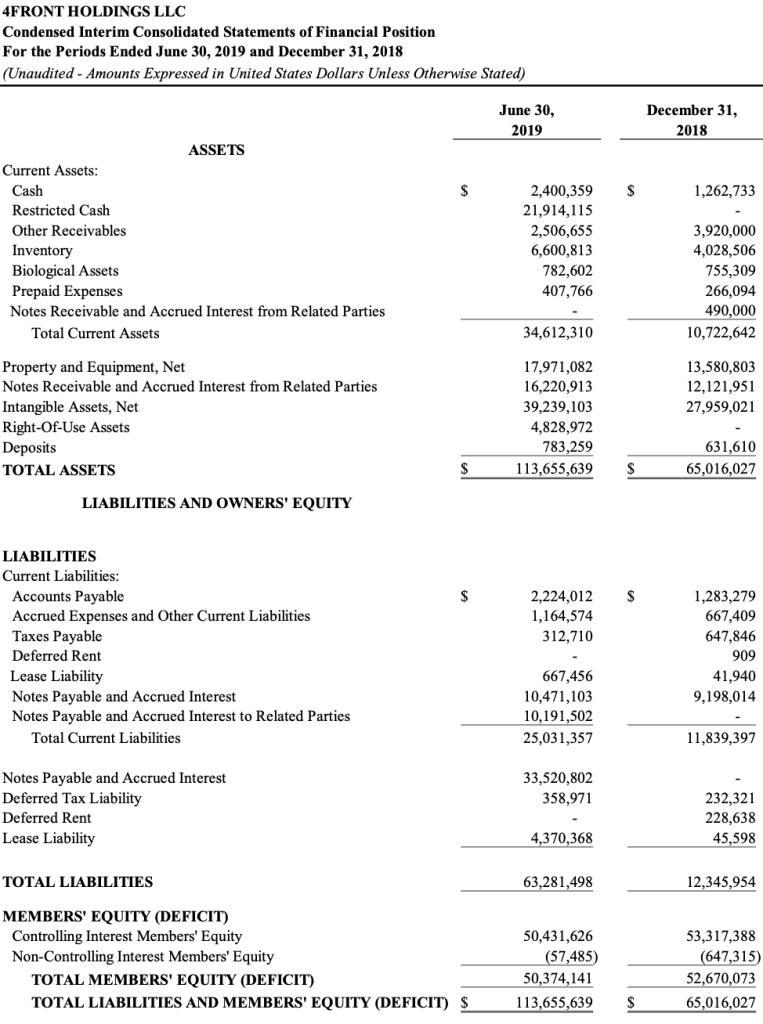

Financial Statements

Non-IFRS Measures, Reconciliation and Discussion

In this press release, 4Front refers to certain non-IFRS financial measures such as Systemwide Pro Forma Revenue and Adjusted EBITDA. These measures do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers. 4Front defines Systemwide Pro Forma Revenue as total revenue plus revenue from entities with which the Company has a management contract but does not consolidate the financial results of per IFRS 10 – Consolidated Financial Statements (net of any management fees), plus revenue from pending and closed acquisitions as if such acquisitions had occurred on January 1, 2019, plus revenue from certain entities to which the Company provides services, sells non-cannabis input materials, and leases the entity’s operating facilities, and which the Company has an option to purchase should applicable state law change (net of any revenues generated by leasing such facilities, selling such input materials, and provision of services). 4Front considers this measure to be an important indicator of the growth and scope of the business. Adjusted EBITDA is defined by the Company as earnings before interest, taxes, depreciation and amortization less share-based compensation expense and one-time charges related to acquisition and financing related costs. 4Front considers these measures to be an important indicator of the financial strength and performance of our business. The following tables provide a reconciliation of each of the non-IFRS measures to its closest IFRS measure.

About 4Front Ventures Corp.

4Front is a cannabis company designed for long-term success and built upon battle-tested operating capabilities at scale, experienced and committed leadership, a strategic asset base, and a commitment to being a magnet for talent. From plant genetics to the cannabis retail experience, 4Front’s team applies expertise across the value chain. 4Front has invested heavily to assemble a comprehensive collection of management skills and hands-on operating expertise to capitalize on the unique growth opportunity being afforded by the increased legalization of cannabis. For more information, visit 4Front’s website.

Investor Contact

Andrew Thut, Chief Investment Officer

[email protected]

602-633-3067

Media Contact

Anne Donohoe / Nick Opich

KCSA Strategic Communications

[email protected] / [email protected]

212-896-1265 / 212-896-1206

This news release was prepared by management of 4Front Ventures, which takes full responsibility for its contents. The Canadian Securities Exchange (“CSE”) has not reviewed and does not accept responsibility for the adequacy of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Forward Looking Statements

Statements in this news release that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in 4Front Ventures’ periodic filings with Canadian securities regulators. When used in this news release, words such as “will, could, plan, estimate, expect, intend, may, potential, believe, should,” and similar expressions, are forward-looking statements.

Forward-looking statements may include, without limitation, statements related to future developments and the business and operations of 4Front Ventures, developments with respect to legislative developments in the United States and the proposed trading dated of the resulting issuer.

Although 4Front Ventures has attempted to identify important factors that could cause actual results, performance or achievements to differ materially from those contained in the forward-looking statements, there can be other factors that cause results, performance or achievements not to be as anticipated, estimated or intended, including, but not limited to: dependence on obtaining regulatory approvals; investing in target companies or projects which have limited or no operating history and are engaged in activities currently considered illegal under U.S. federal laws; change in laws; limited operating history; reliance on management; requirements for additional financing; competition; hindering market growth and state adoption due to inconsistent public opinion and perception of the medical-use and adult-use marijuana industry and; regulatory or political change.

There can be no assurance that such information will prove to be accurate or that management’s expectations or estimates of future developments, circumstances or results will materialize. As a result of these risks and uncertainties, the results or events predicted in these forward-looking statements may differ materially from actual results or events.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release are made as of the date of this release. 4Front Ventures disclaims any intention or obligation to update or revise such information, except as required by applicable law, and 4Front Ventures does not assume any liability for disclosure relating to any other company mentioned herein.