Company is on track for achieving positive cash flow in the second half of 2020.

PHOENIX, Ariz., March 30, 2020 – 4Front Ventures Corp. (CSE: FFNT) (OTCQX: FFNTF) (“4Front” or the “Company“) announced today that as part of its focus on continually increasing operational excellence, reducing capital and operating expenses, and achieving positive cash flow in the second half of 2020, a number of changes have been put in place. The Company also announced strong business trends, corporate overhead reductions and divestiture of non-core assets.

In order to further the focus on operational excellence, the Company’s Board of Directors appointed Leo Gontmakher, previously Chief Operating Officer, to the position of Chief Executive Officer. Former CEO Josh Rosen, will transition to Executive Chairman of the Board of Directors. Nicolle Dorsey, former Executive Vice President of Finance will become the Company’s Chief Financial Officer, replacing former CFO Brad Kotansky.

Mr. Gontmakher co-founded Northwest Cannabis Solutions, which under his leadership grew to be one of the largest and most successful producers of cannabis products in Washington State. He served as Chief Operating Officer at Cannex, which merged with 4Front in July 2019. He has significant experience in cannabis facility design, construction management, equipment sourcing, operations, branding, sales and marketing strategy, and software solutions.

Mr. Rosen commented, “As CEO, it’s been my job to recognize the business needs, including identifying our core capabilities, potential holes and how they map to the market opportunities available. I wholeheartedly believe we have the best team in the industry at efficient, quality indoor cannabis cultivation and low cost finished goods manufacturing. Going back to the early days of 4Front, Kris Krane and I frequently referenced our prioritization on being the best over being the biggest. The legacy Cannex team, complemented by legacy 4Front talent, has executed on what I believe is one of the biggest challenges in the industry, replicating cultivation and manufacturing performance across multiple geographies. I am confident that we’re on the correct path. When mixed with the current retrenchment within our industry, now is the time to more fully empower and support Leo and his core team, making us truly an operator-led company at the top, and allowing me to focus on those areas that maximally leverage my strengths.”

Mr Gontmakher commented, “Following the merger of Cannex with 4Front, we have successfully integrated our operations to become one company and one team. I’m excited to help us take the next step with our laser focus on operational excellence and will continue to lean heavily on Josh and the rest of the leadership team for support.”

Ms. Dorsey was hired by the company as Executive Vice President of Finance in September 2019 with the intended goal of becoming CFO. Prior to joining 4Front, she served as Principal Accounting Officer and Controller at RGS Energy, a publicly traded solar energy company. Her accounting background includes serving as both assistant controller and senior corporate accountant for several public and private companies in various utility and energy industries. Ms. Dorsey has extensive knowledge of technical accounting, financial forecasting, financial analysis, and business operations. She also worked for Cloud Peak Energy, a publicly held coal-producing company, as a senior accountant, and she is a licensed certified public accountant and has a BBA degree in accounting and a Master of Accountancy from the University of Wisconsin.

“We hired Nicolle with the intention that once familiar with our industry and our company that she would become our CFO. Under the leadership and guidance of both Josh and Brad, Nicolle has advanced tremendously and is now fully ready for this role. I’m grateful for Brad’s commitment and dedication to the Company through this transition,” Mr. Gontmakher commented. “With her extensive public company experience and familiarity with our business, we made the decision that now was an appropriate time to elevate Nicolle to her new role as CFO. We couldn’t be more pleased to have her in a position to further leverage her talents as CFO.”

Aggressive Expense Reduction

Consistent with previously announced plans to drive revenue growth and profitability through a focus on core assets and to become cash flow positive in the second half of 2020, the Company began a series of material expense and overhead reduction initiatives.

Over the past four months, corporate headcount has been reduced by nearly 40%, and headcount related to overhead in the Mission stores has been reduced by 45%. These reductions are expected to yield annualized savings of between $7-8 million per year without impacting the Company’s ability to meet previously stated financial goals.

“We continue to take considered and decisive measures to streamline our operational platform and think there are still more efficiencies to be achieved. While making difficult personnel decisions is never easy, a leaner headcount is consistent with our corporate philosophy of low-cost, efficient operations,” said Mr. Gontmakher. “Particularly in uncertain times, maximizing the amount of revenue growth that translates directly to increased EBITDA and cash flow is a high priority.”

Focus on Core Assets and Reduced Capital Requirements

Along with cost reductions, 4Front’s path to achieve positive cash flow is predicated on its prioritization of driving performance in core assets.

“4Front’s core assets are in adult-use markets and afford us the opportunity to meaningfully expand our cultivation and manufacturing capabilities, most notably in Illinois, Massachusetts and California in the future,” Mr. Gontmakher said. “This focus allows us to allocate capital to core businesses that can achieve significant, near-term cash flow.”

To that end, 4Front announced:

- Delaying projects that require significant capital expenditures with uncertain near-term benefits. Most notably, the Company is delaying the launch of its manufacturing facility in Commerce, CA as a result of the challenging conditions that impacted the California adult-use market roll out prior to the COVID-19 pandemic.

- The divestiture of its subsidiary, PHX Interactive LLC, which managed the Mission North Mountain dispensary in Phoenix, Arizona (non-core asset) for $6 million in cash.

Mr. Rosen added, “With the cost of capital remaining high, 4Front is prioritizing the demonstration of battle-tested operating capabilities and near-term cash flow generation, recognizing that a large part of the blue-sky growth opportunity in cannabis is the ability to scale consistent performance across geographies. To support growth and focus, 4Front has now divested interest in two non-core geographies and is considering divesting additional non-core assets.”

The net effect of non-core asset sales and cost cutting measures is a significant reduction in new capital needed to achieve the Company’s goal of positive cash flow in the second half of 2020. The Company estimates it needs an incremental $5 million to reach this goal. “We are in the process of finalizing a private placement to raise at least $5 million consisting mostly of insiders and existing shareholders,” said Mr. Rosen.

Recent Business Performance

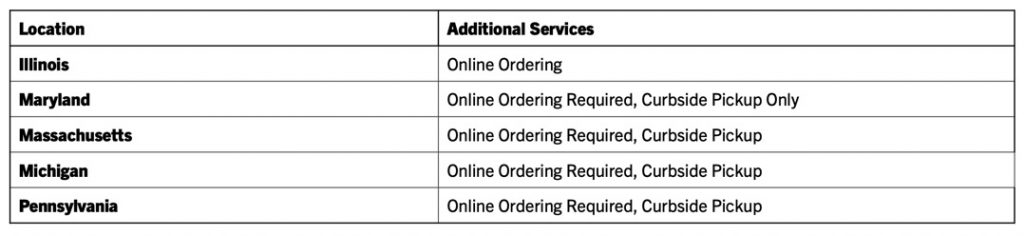

As of March 30, 2020, the Company’s retail stores in the following states remain open and operating with “Essential Service” designations. New services including online ordering and curbside pickup have also been implemented.

Mr. Gontmakher continued, “The safety of our customers and employees is our highest priority. We are monitoring the COVID-19 situation in the U.S. and have proactively taken extra precautions to minimize disruption while adhering to public health guidance. As an Essential Service, we intend to continue to serve our patrons responsibly through this crisis. Despite the uncertainty surrounding COVID-19, we are pleased to see strong sales across our entire platform and expect 4Front to come out a stronger company on the other side.”

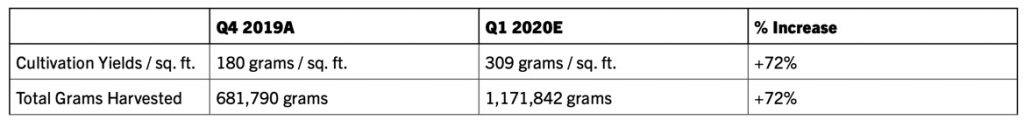

Strong quarter-over-quarter performance is being driven by an 80%+ increase in pro forma systemwide sales at 4Front’s Mission retail locations, as well as continued performance improvements of 4Front’s cultivation and production facilities in Illinois and Massachusetts following the transition of the management of these assets to the team led by Mr. Gontmakher.

Full Year 2019 Earnings Date and 2020 Financial Guidance

The Company plans to announce its fourth quarter 2019 and full-year 2019 financial results, as well as a pre-release of its first quarter 2020 financials, on or before April 30, 2020.

With strong sales momentum and focus on operating efficiencies the Company is on track to meet its previously stated 2020 guidance of systemwide pro forma revenue of $140 million – $180 million in 2020, reported revenue of $100 million – $140 million, and Adjusted EBITDA in 2020 of $10 million – $15 million. However, given the ongoing uncertainty in the market and the economy due to Covid-19, the Company will suspend further formal guidance at this time. The Company expects to provide reinstated guidance for both 2020 and 2021 when it has more visibility into the operating environment.

Non-IFRS Financial Measures

4Front uses Systemwide Pro Forma Revenue, which is not a measurement included in the International Financial Reporting Standards (IFRS), to capture total revenue plus revenue from entities with which the Company has a management contract, or effectively similar relationship (net of any management fee or effectively similar revenue), but does not consolidate the financial results of per IFRS 10 – Consolidated Financial Statements, plus revenue from pending and closed acquisitions as if such acquisitions had occurred on January 1, 2019. 4Front considers this measure to be an appropriate indicator of the growth and scope of the business.

About 4Front Ventures Corp.

4Front is a cannabis company designed for long-term success and built upon battle-tested operating capabilities at scale, experienced and committed leadership, and a strategic asset base. From plant genetics to the cannabis retail experience, 4Front’s team applies expertise across the value chain. 4Front has invested heavily to assemble a comprehensive collection of management skills and hands-on operating expertise to capitalize on the unique growth opportunity being afforded by the increased legalization of cannabis. For more information, visit 4Front’s website.

Investor Contact

Andrew Thut, Chief Investment Officer

[email protected]

602-633-3067

Phil Carlson / Elizabeth Barker

[email protected] / [email protected]

212-896-1233 / 212-896-1203

Media Contact

Anne Donohoe / Nick Opich

KCSA Strategic Communications

[email protected] / [email protected]

212-896-1265 / 212-896-1206

This news release was prepared by management of 4Front Ventures, which takes full responsibility for its contents. The Canadian Securities Exchange (“CSE”) has not reviewed and does not accept responsibility for the adequacy of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

This news release does not constitute an offer to sell or a solicitation of an offer to sell any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.

Forward Looking Statements

Statements in this news release that are forward-looking statements are subject to various risks and uncertainties concerning the specific factors disclosed here and elsewhere in 4Front Ventures’ periodic filings with securities regulators. When used in this news release, words such as “will, could, plan, estimate, expect, intend, may, potential, believe, should,” and similar expressions, are forward-looking statements.

Forward-looking statements may include, without limitation, statements related to future developments and the business and operations of 4Front Ventures, developments with respect to legislative developments in the United States, expectations regarding the COVID-19 pandemic, future revenue or Adjusted EBITDA expectations, and other statements regarding future developments of the business.

Although 4Front Ventures has attempted to identify important factors that could cause actual results, performance or achievements to differ materially from those contained in the forward-looking statements, there can be other factors that cause results, performance or achievements not to be as anticipated, estimated or intended, including, but not limited to: dependence on obtaining regulatory approvals; investing in target companies or projects which have limited or no operating history and are engaged in activities currently considered illegal under U.S. federal laws; change in laws; limited operating history; reliance on management; requirements for additional financing; competition; hindering market growth and state adoption due to inconsistent public opinion and perception of the medical-use and adult-use marijuana industry and; regulatory or political change.

There can be no assurance that such information will prove to be accurate or that management’s expectations or estimates of future developments, circumstances or results will materialize. As a result of these risks and uncertainties, the results or events predicted in these forward-looking statements may differ materially from actual results or events.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release are made as of the date of this release. 4Front Ventures disclaims any intention or obligation to update or revise such information, except as required by applicable law, and 4Front Ventures does not assume any liability for disclosure relating to any other company mentioned herein.